Omneo & Ragtrader Present

Roundtable: Let’s talk about CX

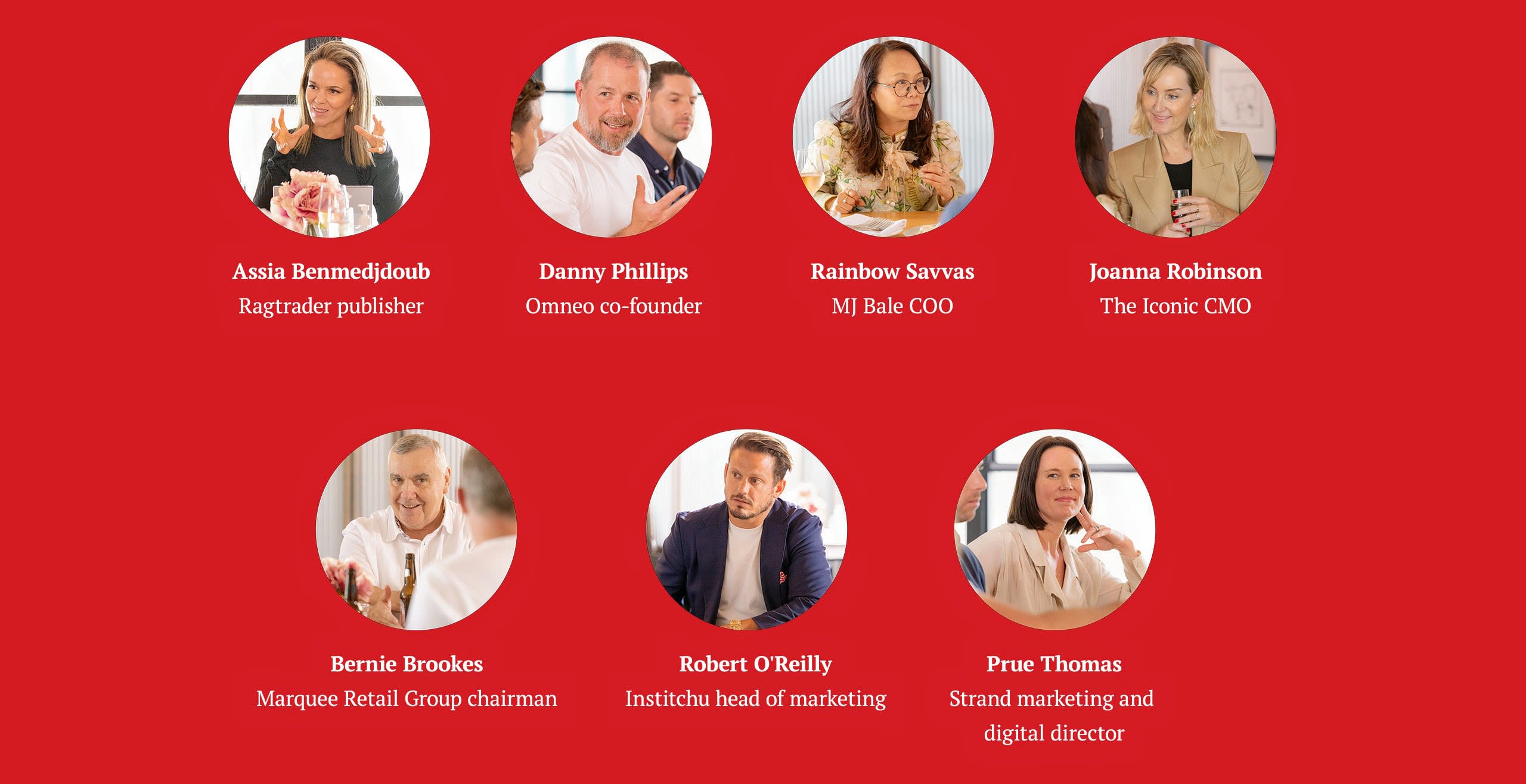

The Omneo Ragtrader roundtable brought together a select group of fashion leaders to unearth how customer experience (CX) tools and principles can improve incremental revenue, customer retention and margins.

Chaired by Ragtrader publisher Assia Benmedjdoub, the panel included Omneo co-founder Danny Phillips, MJ Bale COO Rainbow Savvas, The Iconic CMO Joanna Robinson, Marquee Retail Group chairman Bernie Brookes, Institchu head of marketing Robert O’Reilly and Strand marketing and digital director Prue Thomas.

Assia: We're here today to talk about CX and at heart of this conversation is the customer. Before we delve into the topic, I’d love it if you could share some consumer insights.

Joanna: The Iconic has an active customer shopping database of two million every month, as well as 20 million visits to the website. We’re currently working with a research company to delve more deeply into our target audience from a psychometric profile, not just demographic. We know we skew towards 35 to 55-year-old women because they launched with us twelve years ago and have grown up with the business. I think it’s less about age and more about those progressive, innovative credentials that we’ve had for the last 12 years. The Iconic came out of the gates with really functional propositions around delivery, such as the three hour delivery window, which was how we built our credentials right from the start. The next frontier for us is developing a loyalty program, which we don’t have yet. At the moment, we have two main tiers where our most valuable customers spend on average $5000 a year and shop 33 times and then 50% of our database who come in once a year. How are we going to reach those high value customers and make them feel like VIPs?

Assia: The Strand is on a similar journey around retaining its loyal customers and repositioning for the future. Prue, can you speak to your customer profile?

Prue: We've got an interesting merchandise mix of 50% travel and 50% fashion, so we can also focus on category as opposed to being too blinkered by age segments because they do merge. When we do talk about the group that we consistently target, they're sitting at about 1.3 million active customers and 40% to 45% of those are in that older age bracket. Where we’re really seeing some growth is in the 25 to 35s, particularly in the fashion side because it’s price driven.

Assia: Rainbow, what does the average MJ Bale customer look like?

Rainbow: We’ve probably got around three major customer groups. The 45 to 55-year-old men at one end are very successful, affluent and don't have the current mortgage or cost of living pressures. Then we have the 18 to 25-year-old emerging leaders. I understand Jo’s points around making your loyal customers feel like VIPs. We didn’t have a VIP program when I joined to MJ Bale. We had the catchment of our stores which did really well in our transactional relationship with customers, then over the last probably five years we became a high-touch service business. I think we've got a pretty good reading now of who comes to our doors whether it is in Westfield Centres, standalone stores or concessions. Our loyalty program launched about a year ago and just reported some really great growth over the last twelve months.

Assia: Bernie, you look after a wide portfolio of fashion retail brands and have investments in other sectors. Tell us about your customers and take on loyalty.

Bernie: You know the old statement about 10% of your customers end up yielding let's say 30% to 40% of your sales? It's significantly greater than that. Let’s take an interesting one I’m involved with, which is the TVSN Home Shopping Network. That quite deceivingly is a multi-hundreds of millions of dollars business. People don't quite realise it. It skips under the radar. That business have customers that spend up to $800,000 a year.

Rainbow: Wow, $800,000. Oh, goodness.

Bernie: You've got incredibly sticky customers that sit there for 21 hours of live TV each day and buy things.

Danny: No mortgages.

Rainbow: No mortgages.

Danny: Good interest rates on their savings, right?

Rainbow: A hundred percent.

Bernie: I'm about to break my own rule because I'm going to say the age demographic is 60 to 90, and that has been our age demographic for quite a few years. I don't use the word age demographic and I sort of ban that a lot in my businesses. Why? I think the concept of being able to drive through propensity to purchase through the consumer habitat and the media they consume, that’s more important. If you look at TikTok, you can think it's a young kid's thing. But 48% of the people that consume TikTok are over the age of 35. The whole concept of age and generation has changed. Some of our best customers at Colette by Colette Hayman [a trend-driven accessories retailer under Marquee Retail Group] are not 24-year-olds but 50 to 70-year-olds who are buying bags for their kids and grandkids. So a long answer to say, social demographics and propensity to purchase and basket size and all that are not driven by age anymore, they're driven by the segmentation based on lifestyle and mindset.

Danny: I couldn't agree more. You can tie yourself in knots trying to create personas and customers, but media buying has made marketers sort of have to. You'd be very surprised what crossover segments look like.

Rainbow: A major shift for us in the last two years has been looking at upper funnel investment and brand awareness for new customers when it comes to media buying.

Joanna: We’re going through that stage of growth at the moment. Over the course of twelve years, I think we've lost some of our early entrepreneurial spirit and came out of COVID realising we’d kind of lost of our differentiating benefits. We got very addicted to the paid performance drug and it became less about the customer and more about the purchase. What we've started to do is to really put customer at the core of everything we do.

Rainbow: We used to spend all of our digital marketing expenses, over 90% I would say, on lower funnel conversion. Conversion is everything because you can measure it and see your return.

Assia: Does that formula ever come into play for a custom-tailoring business like Institchu, Rob?

Rob: I came into this role about a year and a half ago and my big priority has also been taking a step back and looking at all the different systems, all the data around customers and purchasing history and where the opportunities are. Given the nature of our business, which is appointment based rather than an off-the-rack or online brand, it runs more like a hospitality business. Our brand proposition has been this idea that custom tailoring can be affordable and accessible - $699 with alterations. The challenge has been to drive that ATV(average transaction value) and order value as high as possible to keep the business moving and not be so dependent on bookings, so we have introduced higher price point fabrics to create say a $1500 two-piece suit. You’re probably getting the same fabric as an off-the-rack design at $3000. This means we’re now having to target a new customer and convince them why we’re a better option than say, a Tom Ford or Tom Brown suit.

Bernie: Pulling from the top rather than trying to compromise value.

Rob: Exactly. You're educating people that custom tailoring is a much better point for value, fit, options and design.

Assia: What's your direct target? Who sits in that middle point where you're like, this is our guy?

Rob: It's probably a 30 to 40-year-old lawyer, banker, someone who wears a suit every day. The other opportunity that we isolated, talking to the key customer, is just around weddings. A wedding order for us is worth four times as much as a corporate order because you're bringing in the groom and bridal party. Talking to that educational piece, it's an awesome onboarding experience because suddenly you've got three groomsmen who may be experiencing InStitchu for the first time. So if you make that experience really good, then you've actually got a whole new customer.

Assia: Do you have a loyalty program?

Rob: We don't. So, this is super interesting to me. We did have one started and it wasn’t quite right, so I folded it.

Danny: I've got a real thing with loyalty programs. What do you think one is and what does it represent to you?

Rob: I suppose better value for incentivised repeat purchases.

Danny: So rewarding the customer?

Rob: Yes.

Danny: It's a really interesting topic to unpack. Just as an anecdote: we had one client and met with three different people. One was in charge of CRM(customer relationship management) and wanted to redo their CRM, one person wanted to do a clienteling project and one wanted to do a loyalty program. So, I met with all three of them and said: you’re all asking for the same thing. Three different people with three different project budgets. Loyalty, clienteling, CRM are the same thing. Personalised and benefits for known customers is loyalty, and loyalty is an outcome, not a reward. Jo, you mentioned The Iconic doesn’t have a loyalty program. Do you sell to known customers you know?

Joanna: 100% and we know who they are, and we can give them secret sales and we can give them access to purchases we know they’d like.

Rob: Personalisation.

Joanna: Personalisation, even on the app and we're doing CRM to segmented customers. So in essence, that is a loyalty program. We just need to make our VIP's feel more like VIP's.

Assia: What roles do the different platforms play in engaging with VIPs and customers in general?

Joanna: We get about 2000 new app downloads a week so we're very app-first led. 50% of our NMV(net merchandise value) is via the app. It's the stickiest, and it's exponential in terms of how we grow it.

Assia: One of the first projects when you joined at Strand was re-platforming, Prue. What’s your take on the different touchpoints and what’s been effective?

Prue: My answer is probably slightly different to everyone else. We moved on some legacy systems and one of the things that made the biggest difference is so simple but it’s the attribution of online sales back to store. That was a big game changer because suddenly, it just removed this huge barrier that business was happening.

Danny: How did you do that?

Prue: We literally just shifted them, so eCommerce became a vehicle for the sales. While we will still report against the eCommerce model, the sales are attributed to the stores.

Bernie: You might have to do it manually at the end of each month, but it's what we're doing.

Prue: It was such a psychological shift. We've got 270 stores so for those stores to suddenly see the sales that customers click and collect was really powerful.

Rainbow: Does that mean you deployed a mechanism that will reward the store staff for the sales that's actually attributed to online?

Prue: Yes. So, the sales that come off the website go attributed directly to that store. If it is a click and collect sale, there is an additional attribution.

Rainbow: So before it was more siloed.

Prue: Yeah. That was game changer for us. It gave an incentive to the store staff in the sense that they weren't being taken away from a sale that would be considered theirs.

Rainbow: From serving a customer, absolutely. So, it’s the same order of a priority.

Prue: Yes but then interestingly, there's certain stores in certain locations that have taken it kind of to the next level where they are better performing click and collect stores because they've had such great experiences. Customers have had great experiences, so suddenly those stores are click and collect heroes.

Danny: We've seen some examples of this where in the early days of eCommerce, it was seen as separate. For retailers that have gone the other way, in the same way you have, they'll turn on their point of sale at 9am and they’re already at $2,400. All the people you served yesterday went home and bought them online.

Prue: All those unfulfilled sales are coming back into them, so they look like they're already on a winner. Don't underestimate the power of those triggers with the staff in those stores.

Danny: We've got this thing now where we're introducing this idea of abandoned cart for store, where you should get a receipt for your time. “I bought that, but I like this.” Scan it into your wish list, get an email, buy it online tonight and the store still gets credit for it. Especially when you've got maybe what, a 20% or 30% conversion rate in store at best. A lot of people are spending time in store, if they don't buy anything, they get no receipt for that time.

Prue: It's so interesting, the abandoned cart aspect. We're seeing something really interesting happen probably over the last six months or so. As we've gone broader from a targeting perspective, the abandoned cart from an online shopper is coming into store and being transacted on.

Assia: Strand stores have also been modernised recently right? With mobile POS making things less centralised.

Prue: Pretty much. So those mobile POS are linked to the site - to those click and collects and to everything else - and it frees the staff up to the teams in the stores to just circulate more, as opposed to standing behind a till waiting for a customer.

Rainbow: I have a question. When you say mobilise the POS from click and collect, can you elaborate more on that?

Prue: The click and collect mechanism at the moment is we've got a three-hour model happening. So, it's three hours and it’s one hour in metros, but we're still in testing phase for that.

Rainbow: How do they urge a customer to collect? The common collect time for us is four weeks.

Prue: If it gets to a stage where the stock has been in store for two weeks, they move into a CRM flow and incentivise the collection.

Rainbow: How long have you been deploying that mechanism?

Prue: The click and collect model is evolving all the time and I think in the last twelve months, it's probably gone through about six different iterations.

Assia: How are you approaching CX with Colette By Colette Hayman and The Daily Edited, Bernie?

Bernie: We're playing catch up at the moment because we bought those businesses from administration, so we had to clean them up. Click and collect is about 20% of the business and growing at an exponential rate. It surprised us how big it would be when you consider other businesses that we've run, they're nowhere near as big as that. I don't know why, but we don't have too many click and collect orders left at the end of two weeks. It’s not raised itself as an issue.

Prue: Is that with Colette?

Bernie: Yes. I mean, that's a young girl that has a limited disposable income and so if she has paid $50 or $60 for a bag, she's going to come and pick it up. She's also shopping a lot more frequently than an average customer because she's in the mall, so maybe it's a little bit easier. The other concept we haven’t found is the idea that when they come in to collect, they buy something. They actually don't. Every time we run the research on it and look at it, there might be a little bit of it but they come in, they want their sale and off they go. They're on a mission.

Rainbow: Did you incentivise that?

Bernie: We've tried giving 10% off jewellery, or a three for $20 jewellery offer, but at the moment, it's really hard to get. So, maybe we just haven't found a secret sauce.

Assia: Rainbow, what strategies have been successful in growing your sales at MJ Bale?

Rainbow: I think our loyalty program would be number one and the personalisation that comes from knowing our customer. Are you a lawyer, are you a CEO, how frequently do you shop, what are your milestones.

Assia: Can you give me an example of a specific campaign or strategy you've created for loyalty customers that has had a solid return?

Rainbow: We ran a campaign for two weeks where customers could win a double ticket to The Birdcage. There was no minimum of how much they had to purchase to enter but we would cover flights, accommodation and expenses on the day. We actually got a reaction from customers of about 3000 entries and serious spending to around about $1 million.

Bernie: The dilemma is how much you give away on price to your top tier. As a top tier customer, they might get extra points but ultimately the money-can't-buy experiences is what drives people. When we launched the Myer One program at my time as CEO, it was aimed at five million customers. It was aimed at that top tier getting not another discount, but 180 of them to the races in The Marquee on Oaks Day. We’d take them to our fashion show launch two or three times a year. Jamie Oliver had come to town - and we'd take them to a night with Jamie Oliver. We'd take them to any theatre launches. They became a clan of 180 people that spent a couple of hundred thousand dollars a year with us, and that's what drove that.

Prue: They also become your brand ambassadors.

Bernie: Yes. I think the concept of a loyalty program now is another form of markdown. So you've got to be really careful. If your markdowns are 20% in a business and you put a loyalty program in where everybody presents a business case of reducing markdowns to 15%...

Danny:…with 5% on top.

Bernie: Yeah, exactly. It's going to cost us 3% to run the program. Are you confident you're going to keep your markdowns at 15%? You look twelve months later, markdowns are still 20%, you're now spending 3% for the loyalty program and you're paying for all this money can't buy experiences. So, it is a trap. I think you've got to begin with an end in mind and begin with some rules to start, otherwise you end up compromising. What is the business case you’re trying to achieve?

Danny: We’re talking about the idea of ‘status, access, power and stuff’ in that order. Often, most loyalty programs don't get above stuff, discounts and those other things are what people really want.

Assia: What data would be valuable to you in pursuing more personalised CX experiences in general?

Joanna: With the degradation of cookies, I think you have to work even harder to drive a relationship with the customer. There’s nothing more frustrating than being hit by advertising or messaging that's irrelevant, especially when there's so much noise out there. In terms of what we’re doing data wise, we're leaning heavily on our partners and analysing where we're winning and losing with customers. There’s only 27 million people in Australia and once you segment them down, we're not in Europe or some of these bigger markets where it's all about size of opportunity. We've got a small segment. So you have to be really about differentiated in terms of retention and it has to be about experience, not trying to be all things for all people.

Assia: Do you have any specific strategies to retain customers?

Joanna: We're a tech company so at the end of the day, it's about how we utilise that and our product team to create a personalised experience. We did a whole campaign recently that was built on the inside around wish listing. We know that if we can get people to wish list, that one in four will convert. So, we did the ‘Shop That Stops The Nation’ campaign for our 12th birthday, which was actually the first time that we've done a full funnel campaign for a while. It was around getting more people to download the app, to wish list, to just get sticky and to re-engage with our brand. We tied it into our birthday and gave customers a one in three chance to win a wishlist gift if they were on The Iconic when we ‘stopped time’ for two minutes every hour. It went gang busters and blew away all the metrics.

Assia: What do you think the loyalty program will look like if it's not discount and promotion based?

Joanna: Experience. Curation. Everything that Bernie was just talking about in terms of tier one customers and making your VIP's feel like VIP's, who then become your brand ambassadors. I talk about this all the time. Awareness, consideration, purchase, loyalty, that's the Holy Grail. You push people down the funnel and they become your influencers and your brand ambassadors instead of being transactional.

Prue: But then that's a hard drug to come off because customers also love deals.

Joanna: A hundred percent, it is.

Assia: How did you approach loyalty and retention when rebranding from Strandbags to Strand?

Prue: We did have a risk piece around potentially alienating that core but that hasn't happened. They're still coming into their store because it's a community. On the other side, we've also spent a lot of time this year on another valuable segment, young families. Travel had a record year last year. We did some research and asked: how often would you shop for travel? It was once every three years. We want to see customers before three years. So, how do we kind of then start to tailor those messages? It really comes down to content and yes, there is still a promotional strategy in place too.

Assia: Is it hard managing a free delivery proposition when it comes to acquisition of new customers?

Bernie: There’s a pull back on endless free returns and it's happening in Europe. You can start to see the Zara's, they're now charging in certain markets. In the UK, Marks & Spencer and ASOS are all charging. They're doing it because of the ‘buy ten, return eight’ mentality. Their plan is to move towards charging everybody for delivery. Then for their loyal customers, they'll give them the free delivery service. That becomes an advantage.

Danny: Prove it over time.

Bernie: Yes. It's only a matter of time before most customers will pay for delivery returns back in Australia. Once they start to pay for it, it's an entirely different order and return mentality. They’ll want to go in and try their size instead ordering ten.

Rainbow: I think that is more from a pureplay model, so from a hybrid like us we’re around about 20% which is a good benchmark. If that goes above 20%, we’d want to investigate why returns are happening.

Assia: To Bernie’s point about future trends, what’s next for you all on the CX journey?

Rainbow: We are just about to take off with personalisation in conjunction with our existing customer platform Omneo. With the fading of third-party cookies, being able to track customers behaviour and maintain privacy is so important. I think that's where we're going to steer into: that buzz around hyper customer personalisation.

Prue: For us AI, predominantly in customer service. We’ll probably have this conversation in a year's time and it will be irrelevant because it will just be so commonplace in terms of how we use it and what we use it for. In terms of resources and roles, AI is not a replacement but it is going to help make jobs better and make things more efficient. It's going to let our teams service the customer and be more front facing.

Joanna: The biggest area of opportunity for us at the moment is about increasing discoverability on site. So being able to curate and deliver items to people beyond tagging. How do we get really clever with discoverability if obviously we don't have window dressing, that physical retail element?

Assia: You guys have had some amazing in-house devs teams too…

Joanna: The test and trial is constant. We're working with the product team in terms of what's the roadmap for the dial shifters. We’ve been guilty of running after shiny new balls so how do we focus on five things that are going to nail 2024.

Rainbow: Right, there are so many shiny toys. How do we get the best benefit out of the shiny toys we developed in the last 12 months?

Assia: It can be an overwhelm when there’s so much new technology entering the market.

Prue: There are sacred cows, particularly in the tech space. Because businesses have spent a lot of money on them, they become real legacy problems that people have to make work. Well, actually you have to do the brave thing, which is cut it off.

Bernie: It’s actually not a tough decision if you're not an egocentric CEO or board. When I was running the Wesfarmers business in Africa, we had 17,000 stores and were doing $30 billion in turnover. We wrote off a couple of billion dollars in technology and it actually became an easy decision because it was the wrong business case. The problem with businesses today is they don't make those tough decisions because they're all driven by the ticker tape of the share price on the top. Sometimes the toughest, hardest decisions are the right decision financially. Don't be worried about writing off significant sums of money if it's not customer driven and it's not delivering on the original and the predicated business case.

Assia: What’s a key customer focus for you in the current business?

Bernie: I think people forget that you got to get the basics right and the most important system in a retailer is the POS system. If you ain't got the POS system right and it's unfriendly to the customer, you're screwed. So, I think get the basics right first, and that's probably - we're a little bit more advanced than that - but get the basics right. We [Marquee Retail Group] have got a loyalty program that recently launched called Front Row, and the reason we're called a Front Row and not Love Colette, which is what it used to be called, is we can use it across all our brands. I've got a CEO in place that ran Myer One and the largest loyalty program in Africa, so she knows what she's doing.

Assia: How do you structure that loyalty program, given the businesses are a different size to say Myer?

Bernie: I've got 700,000 Colette customers so it’s having this debate and looking at what a small or medium brand can provide versus The Iconic, which is a big company and has an advantage to be able to create experiences through partner brands. Do customers want to visit the factory in Guangzhou? For us, it is a form of reducing my markdowns. Instead of running 30% off, I run a buy a bag and get a second one at 50% off, which is a 25% markdown.

Danny: It feels better than what it costs.

Bernie: Yeah. If you think of something more sexy than that and it's going to make sticky customers more customers, throw it out the window unless you're a big company and you can do it.

Assia: It's measured on scale and strategy.

Joanna: But isn't it always about driving frequency and ATV? I mean, in the end, you want them to come back more often and spend more.

Bernie: And collecting data, because if they don't give you the data, you can't do it.

Joanna: Exactly, yeah, but it's a loop, isn't it? The more you know, the more you can get them to come back more frequently and spend more.

Assia: How do you manage that purchase loop in a business like custom tailoring, Rob? What’s ahead for you guys?

Rob: I think we're about to have our best week ever on record so, we're still kind of growing and growing that side of the business. I suppose one of the things our owners are smartly doing is going: okay, if we own the tech behind our custom tailoring services, how can we help take custom tailoring into the world in a way that's risk free? So they've white labelled the technology that powers us and they're now selling that to other retailers. If it's an off the rack brand, they can offer made-to-measure in store without having to develop the technology themselves. So, we've launched in Brooks Brothers India, we've launched in Barkers in New Zealand, there's a whole bunch of other people coming on board with that. So, it's kind of...

Assia: Are you selling the proprietary technology to other brands as a subscription service?

Rob: Yeah, as a subscription service. That's going to be a big part of our growth journey over the next year. Weddings is also a big part of our business, I would say 50%.

Assia: With the level of customisation that happens in showrooms for wedding and corporate bookings, what compels the brand to keep an eCommerce presence?

Rob: We know that once a customer has had a showroom booking, we’ve got a 100% conversion rate or pretty close to that number. It's like a hairdresser, you don't book in and then not get the haircut. Once they go to two or three or four appointments, they're locked in for life. Being able to reorder online becomes a convenience because that showroom experience is about getting measurements, having a whiskey and a half an hour experience with a stylist. It really is a one-to-one service.

Assia: It’s been so interesting to hear from such a broad range of retail players. Thank you all for sharing some incredible insights with Ragtrader and Omneo.

This transcript has been edited down for brevity.